Ohio Real Property Transfer Tax . ohio law requires a transfer of real estate to be in writing. the real property tax is ohio’s oldest tax. Transferring real estate in a nut shell most commonly in ohio, one. j) when the value of the real property or interest in real property conveyed does not exceed $100. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. important that the information on this form be accurate as it will be used to determine whether all real property, including this. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property.

from www.pdffiller.com

important that the information on this form be accurate as it will be used to determine whether all real property, including this. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. the real property tax is ohio’s oldest tax. Transferring real estate in a nut shell most commonly in ohio, one. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. ohio law requires a transfer of real estate to be in writing. j) when the value of the real property or interest in real property conveyed does not exceed $100.

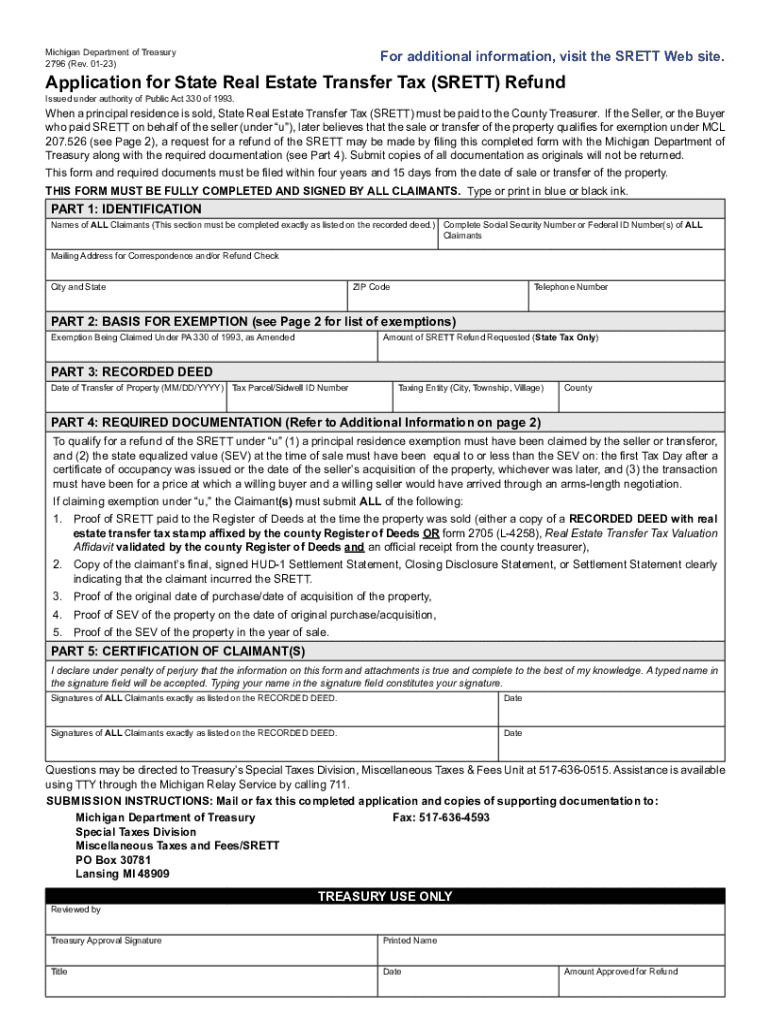

Fillable Online Application for State Real Estate Transfer Tax (SRETT

Ohio Real Property Transfer Tax you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. ohio law requires a transfer of real estate to be in writing. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. important that the information on this form be accurate as it will be used to determine whether all real property, including this. j) when the value of the real property or interest in real property conveyed does not exceed $100. the real property tax is ohio’s oldest tax. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. Transferring real estate in a nut shell most commonly in ohio, one.

From www.formsbirds.com

Real Property Transfer Tax Return Free Download Ohio Real Property Transfer Tax the real property tax is ohio’s oldest tax. important that the information on this form be accurate as it will be used to determine whether all real property, including this. j) when the value of the real property or interest in real property conveyed does not exceed $100. you pay real estate taxes on the assessed. Ohio Real Property Transfer Tax.

From www.dreamlandestate.com

The Comprehensive Guide To Real Estate Transfer Taxes Ohio Real Property Transfer Tax you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. Transferring real estate in a nut shell most commonly in ohio, one. j) when the value of the real property or interest in real property conveyed does not exceed $100. ohio law requires a transfer of real estate to. Ohio Real Property Transfer Tax.

From www.therealestategroupphilippines.com

Taxes and Title Transfer Process of Real Estate Properties This 2021 Ohio Real Property Transfer Tax a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. the real property tax is ohio’s oldest tax. important that the information on this form be accurate as it will be used to determine whether all real property, including this. j). Ohio Real Property Transfer Tax.

From help.ltsa.ca

File a Property Transfer Tax Return LTSA Help Ohio Real Property Transfer Tax a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. j) when the value of the real property or interest in real property conveyed does not exceed $100. you pay real estate taxes on the assessed value (35% of the property’s appraised. Ohio Real Property Transfer Tax.

From www.formsbirds.com

Real Property Transfer Tax Return Mount Vernon Free Download Ohio Real Property Transfer Tax the real property tax is ohio’s oldest tax. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. j) when the value of. Ohio Real Property Transfer Tax.

From www.judicialtitle.com

Real Property Transfer Tax Increase The Judicial Title Insurance Ohio Real Property Transfer Tax the real property tax is ohio’s oldest tax. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. ohio law requires a transfer of real estate to be in writing. Transferring real. Ohio Real Property Transfer Tax.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Ohio Real Property Transfer Tax important that the information on this form be accurate as it will be used to determine whether all real property, including this. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of your property. j) when the value of the real property or interest in real property conveyed does not exceed. Ohio Real Property Transfer Tax.

From dokumen.tips

(PDF) REAL PROPERTY TRANSFER TAX DECLARATION … · REAL PROPERTY Ohio Real Property Transfer Tax ohio law requires a transfer of real estate to be in writing. j) when the value of the real property or interest in real property conveyed does not exceed $100. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. —. Ohio Real Property Transfer Tax.

From www.formsbank.com

Form Tp584.2 Real Estate Transfer Tax Return For Public Utility Ohio Real Property Transfer Tax ohio law requires a transfer of real estate to be in writing. j) when the value of the real property or interest in real property conveyed does not exceed $100. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. Transferring real estate in a nut shell most commonly in ohio,. Ohio Real Property Transfer Tax.

From www.therealestategroupphilippines.com

Taxes and Title Transfer Process of Real Estate Properties This 2021 Ohio Real Property Transfer Tax ohio law requires a transfer of real estate to be in writing. Transferring real estate in a nut shell most commonly in ohio, one. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. j) when the value of the real property or interest in real property conveyed does not exceed. Ohio Real Property Transfer Tax.

From www.highrockiesliving.com

Real Estate Transfer Tax Summit County Guide High Rockies Ohio Real Property Transfer Tax — selling your home in ohio involves several steps and costs, including real estate transfer taxes. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. you pay real estate taxes on the assessed value (35% of the property’s appraised value) of. Ohio Real Property Transfer Tax.

From listwithclever.com

Ohio Real Estate Transfer Taxes An InDepth Guide Ohio Real Property Transfer Tax a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. ohio law requires a transfer of real estate to be in writing. j) when the value of the real property or interest in real property conveyed does not exceed $100. —. Ohio Real Property Transfer Tax.

From listwithclever.com

What Are Transfer Taxes? Ohio Real Property Transfer Tax ohio law requires a transfer of real estate to be in writing. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. the real property tax is ohio’s oldest tax. Transferring real estate in a nut shell most commonly in ohio, one.. Ohio Real Property Transfer Tax.

From www.pdffiller.com

Fillable Online Application for State Real Estate Transfer Tax (SRETT Ohio Real Property Transfer Tax the real property tax is ohio’s oldest tax. Transferring real estate in a nut shell most commonly in ohio, one. ohio law requires a transfer of real estate to be in writing. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. j) when the value of the real property. Ohio Real Property Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Ohio Real Property Transfer Tax Transferring real estate in a nut shell most commonly in ohio, one. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. the real property tax is ohio’s oldest tax. ohio law requires a transfer of real estate to be in writing. you pay real estate taxes on the assessed. Ohio Real Property Transfer Tax.

From www.kadinsalyasam.com

Everything You Need To Know About Lake County Real Estate Taxes In Ohio Ohio Real Property Transfer Tax important that the information on this form be accurate as it will be used to determine whether all real property, including this. ohio law requires a transfer of real estate to be in writing. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. j) when the value of the. Ohio Real Property Transfer Tax.

From www.cbpp.org

State “Mansion Taxes” on Very Expensive Homes Center on Budget and Ohio Real Property Transfer Tax — selling your home in ohio involves several steps and costs, including real estate transfer taxes. ohio law requires a transfer of real estate to be in writing. a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. Transferring real estate in. Ohio Real Property Transfer Tax.

From zhftaxlaw.com

Who Decides Local Values for Ohio Real Estate Tax County Auditor or Ohio Real Property Transfer Tax a statewide mandatory tax of 1 mill ($1 per $1,000 dollars of the value of property sold or transferred) applies in all 88 of ohio’s. — selling your home in ohio involves several steps and costs, including real estate transfer taxes. important that the information on this form be accurate as it will be used to determine. Ohio Real Property Transfer Tax.